I published this article first on medium. You can read the same article on Medium here

A conversation earlier today between me and a mate had us wondering whether cryptocurrency would trigger a massive correction in the Australian property market. I think cryptocurrency is going to play a role in Australian real estate in the short term as well as in the long run.

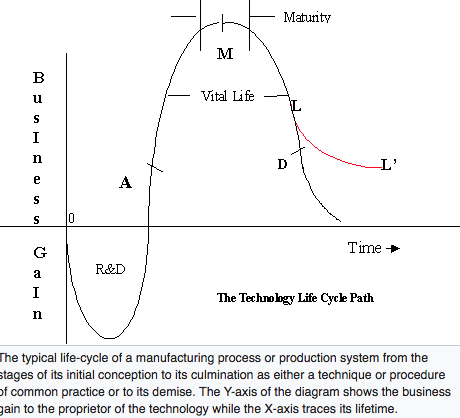

In today’s hyper-connected economy, any disruption would cause a correction, or at the very least, fluctuations, in seemingly unrelated markets. The bewilderingly rapid adoption of cryptocurrency over the past 10 years makes me rate crypto amongst the top three disruptors over coming years (AI and biotech being the other two). While AI and biotech are value creators, crypto serves as a value measurement device to transactions. This is very important because value measurement is horizontal to any value chain (a role that conventional fiat currency and the finance sector currently plays). So, we can argue that by definition, crypto has the potential to impact sectors beyond its primary value chain. As more and more mainstream folk have begun to adopt crypto, traditional financial instruments are scrambling to share a piece of the pie . This trend is all too similar to a technology product manager, who sees these adoption cycles with the “S-curve”.

PC: wikipedia

Riding the wave of the ascent phase and inching close to the maturity phase of the cryptocurrency S-curve, we’re now seeing lower volatility than before in the daily price movements of big players such as Bitcoin and Ethereum. Sure, you may point to the recent hard forks as an example of its frialty, but I expect these to stabilise in the coming years as crypto continues to become more mainstream as well as with the introduction of derivatives such as futures and options to hedge out the fluctuations. The inherent non-inflationary aspect of cryptocurrency will make it fundamentally more attractive to a regular investor than traditional currency, that requires considerable effort on the investor just to stay at par value year on year. This attractiveness will likely push fiat currencies towards even higher inflation causing traditional currency to lose even more value over time.

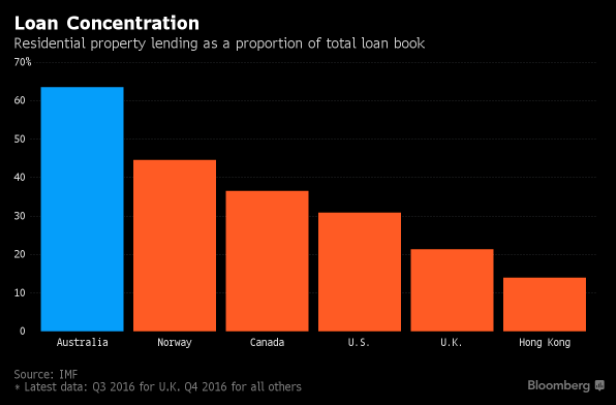

So what does all this mean for the australian real estate market? Real estate is a fundamental store of value. However, the close association of the real estate market with the debt market in Australia is something that can’t be overlooked. To quote an article from a newspaper a couple of months ago: “Over 60 per cent of the Australian banking system’s loan book is in residential property, nearly 20 per centage points more than second-placed Norway and more than double the US ratio, according to data from the International Monetary Fund. In Hong Kong’s frothy housing market, the ratio stands at only 14 per cent.”

PC: Mortgage lending as a proportion of total loans

To tie it all together, as crypto adoption increases over time, we will see more people transitioning from their fiat currencies in order to accumulate cryptocurrency. I think that the likelihood that such transitions will cause a correction in our mortgage debt filled economy is highly likely. On the other hand, since bricks and mortar real estate stores actual value, we will see more trades between housing and cryptocurrency directly. This trend, which has already begun, should act as a cushion against major price variations in the housing real estate market in the short term. Over the long term, if the meteoric rise of cryptocurrency continues along the same trend line, the medium of transaction and value transfer in housing will simply shift from traditional currency to cryptocurrency — along with no loss of inherent value.

The bigger question I ask myself is what would happen to people and entities who are inherently vested in fiat economy debt such as mortgages and bonds, and unwilling/unable to adapt? Inflationary currencies such as fiat and non-inflationary currencies such as crypto can’t co-exist sustainably. As mortgages lose more value over time, it’s possible that everyone who already owes mortgage debt will see the debt diminish in value, maybe even ultimately vanish. Wouldn’t that be interesting!

Most of us living in the 21st century can agree that we’re living through what the ancient Chinese saying might call “interesting times”. I think the best way to make the most of these times is to stay diversified and to embrace change!

Notes:

- Cover Image courtesy: btcethereum

Leave a Comment