I recently came across Khanh Nguyen Nam’s excellent answer on Quora about why gamers hate Bitcoin these days. This got me thinking about the unsung hero behind two most important technological innovations of this decade - cryptocurrency and Artificial Intelligence. I’m talking about the gaming industry and the Graphics Processing Unit or GPU. cover image source

GPUs have been a staple in the gaming industry since the late 90s, helping game developers harness its ability to perform massively parallel computations, thus rendering beautiful virtual worlds and complex game scenarios. Around 2009-2011 however, two different industries got a new lease of life when someone discovered that embarrassingly large data along with massively parallel computations actually increase the quality and efficiency of the output. This led to a surge in applications that use deep learning (within artificial intelligence) and proof-of-work algorithm mining (within cryptocurrency and blockchain). Probably someone else connected the dots and realised that the same gaming graphics card that processes sunsets and cop car chases in parallel, can be tweaked and repurposed to perform linear algebra and image convolutions for deep learning as well as solve algorithmic hashes for crypto mining, thereby using parallelism to outperform the then-state-of-the-art CPU traditional computing clusters. This led to the rise of GPU as a generalised parallel stream computing device. Today, GPUs have become the go-to computing processor for machine learning, self driving cars, image processing, financial markets and cryptocurrency ‘proof-of-work’ mining.

While GPUs have clearly impacted these exponential technologies in a massive way, its more interesting to see the impact of the adoption of these technologies on GPUs.

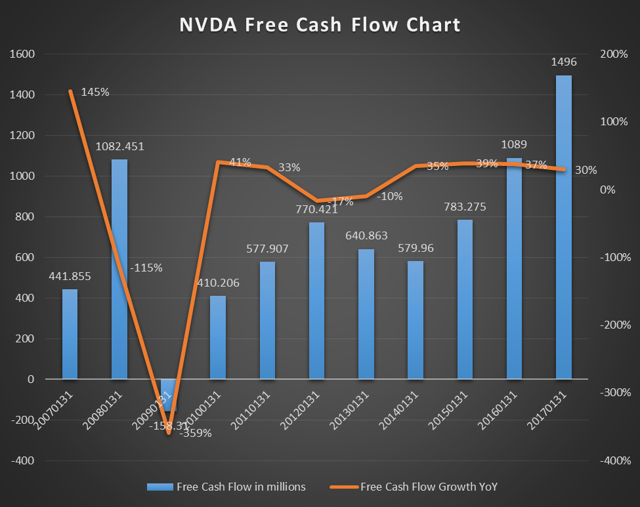

1) Deep Learning and GPU powered Artificial Intelligence have a naturally high barrier to entry given the highly technical nature of work and non-obvious amateur applications. Deep learning enthusiasts and practitioners have found it easier to turn to cloud based providers such as Google Cloud, AWS and Azure to perform computations at scale. With centralised hardware providers being the main demand drivers, it’s likely that GPU supply and delivery is consistent and governed by supply side contracts. This has undoubtedly been beneficial for the GPU companies’ bottomline. You can see this in NVidia’s very healthy 30% YoY free cash flows:

image source

image source

2) Cryptocurrency adoption into the mainstream was more rapid. In a short span of years and reaching its pinnacle in 2017, regular folk like the couple in the image below respond to soaring cryptocurrency prices and stock up towers of GPUs to pursue cryptocurrency mining.

image source

image source

More and more gamers have complained of GPU stockouts at their local computer store because the store just sold the entire batch of GPUs to some crypto miner. This sudden demand for cryptocurrency cards has however arisen in the consumer GPU market, exposing the centralised retail market’s inability to scale quickly to unexpected demand. Khanh Nguyen puts it nicely when he says that a GTX 1070 GPU card that was previously $420 now averages to ~900 dollars. Being unable to afford crucial hardware, PC gamers are forced to move to gaming consoles. On the flip-side, Nvidia’s revenue from gaming sales rose 59% sequentially during fiscal 3Q17, possibly due to its new products for Apple MacBook users. Additionally, the shifting sands of the crypto mining ecosystem is seeing GPUs give way to specialised mining chips called ASICs (Application-specific integrated circuit) towards the second half of 2017. It’ll be interesting to see how this dynamic plays out in 2018.

Nonetheless, it’s interesting and frankly saddening to see PC gamers suffer silently as the GPU industry undergoes a shift in value proposition.

Leave a Comment